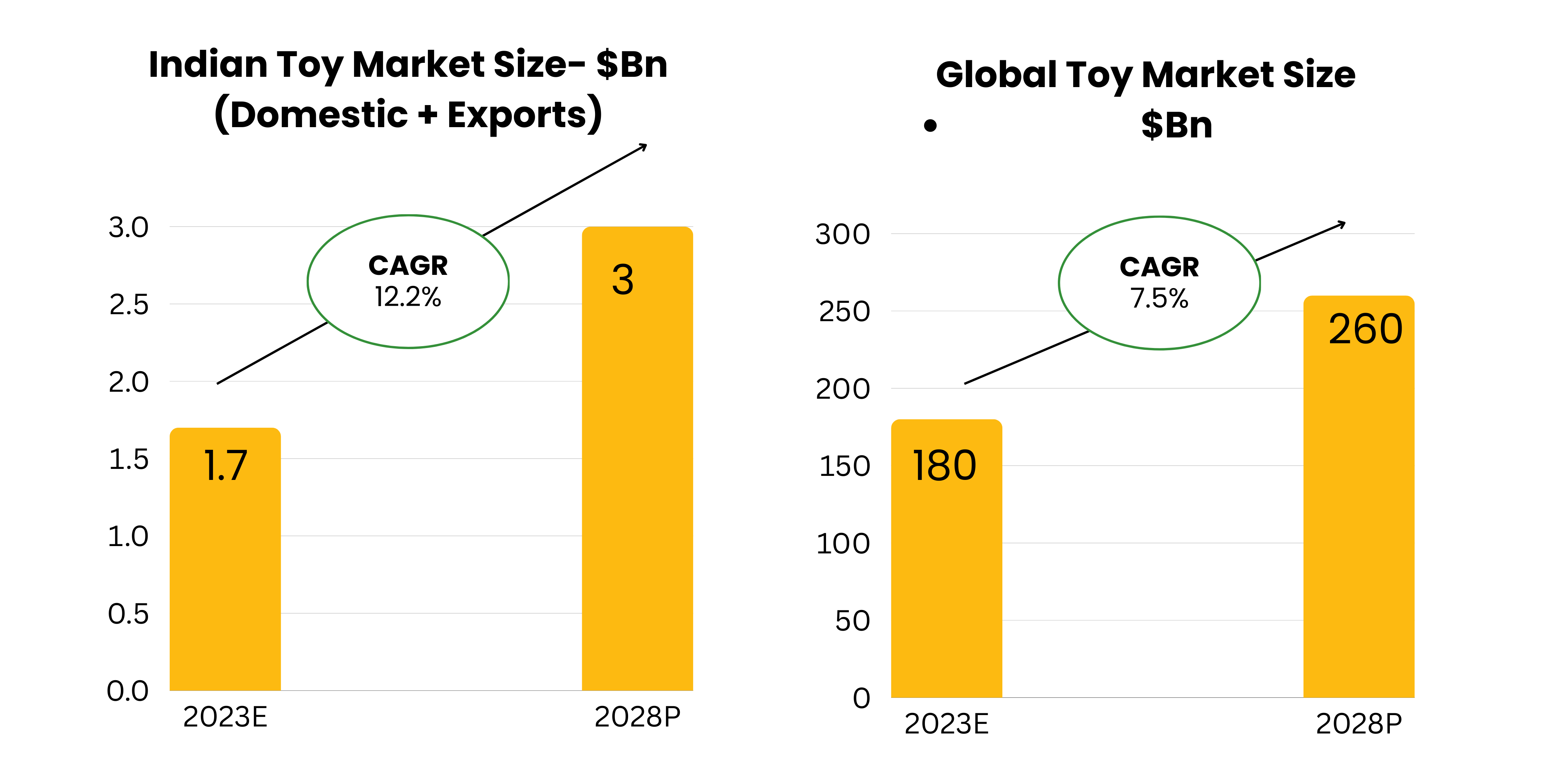

The Opportunity

India Toy Story

The Indigenisation of toys and China + 1 story:

“China is no longer the low-cost producer of anything. It’s only the pre-existing sunk costs of the industrial plant. I realise that you don’t move that industrial plant overnight, but if it’s going to die anyway, sooner rather than later.” Peter Zeihan, Geopolitical analyst

India has traditionally been a net importer of toys. During the 2016–2020 period, China accounted for 86% of India’s total toy imports for domestic consumption. China has historically dominated the toy manufacturing sector, benefiting from a large, cheap labour force and established supply chains. However, the competitiveness of China is decreasing due to several reasons:

Rising Labour Costs: As China’s economy has developed, wages have increased significantly, making it less viable for low-cost production of toys. The GDP per capita in China has risen from $195 in 1980 to $10,500 in 2020, leading to higher expectations for wages among workers.

Labour Shortages: China’s demographic challenges, including a declining birth rate and an aging population, have resulted in a labour shortage. Analysts estimate that China has around 20 million fewer workers than needed, a situation that is expected to worsen over time.

Geopolitical Risks: The geopolitical relationship between the USA and China has become increasingly strained, raising concerns over supply chain stability and reliability.

India is emerging as a significant alternative to China for toy production due to:

Increase in Basic Customs Duty (BCD): A substantial increase in BCD on toys (from 20% to 60% in February 2020, and subsequently to 70% in March 2023) aims to protect the domestic toy industry from cheaper imports and encourage local manufacturing

Massive Labour Pool: India has a young and abundant workforce, with over 400 million people available for work. This demographic advantage ensures a continued supply of low-cost labour for the foreseeable future. While Vietnam, Indonesia and Mexico are strong contenders, India has the advantage of cheap labour. India’s labour cost is 1/5th of China’s and half of Vietnam’s. Hasbro plans to de-risk 60% of its sourcing from China by 2025 and looking to move its sourcing to Vietnam and Indian suppliers.

Industrial Capacity: India possesses latent industrial capacity and is actively working to develop a full local supply chain for toy manufacturing. This potential for capacity uplift is unmatched by other countries, making India a key player in the future of toy production.

Strategic Supply Chain Diversification: Covid 19 pandemic, increased trade restrictions on Chinese imports, and supply chain disruptions have exposed the vulnerabilities of being over- dependent on a single supply source. As companies look to diversify their supply chains away from China, India stands out as the only country capable of matching China’s production capacity in the long term.

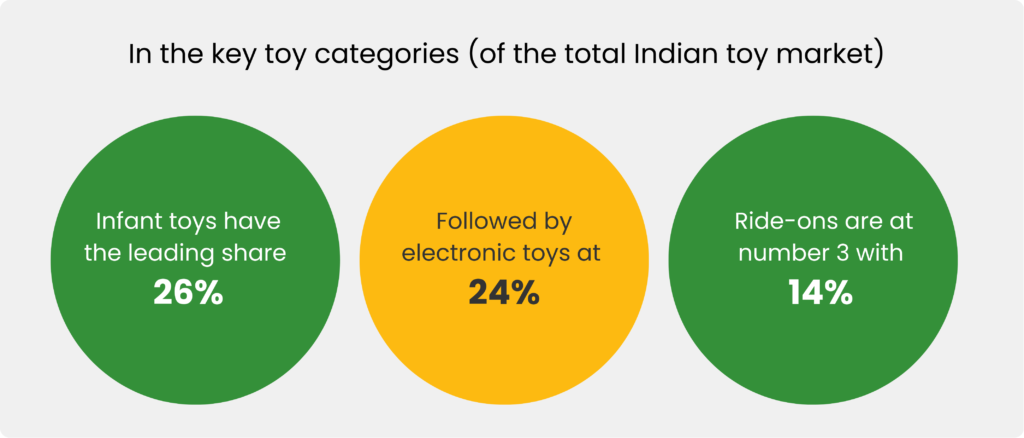

Key Categories:

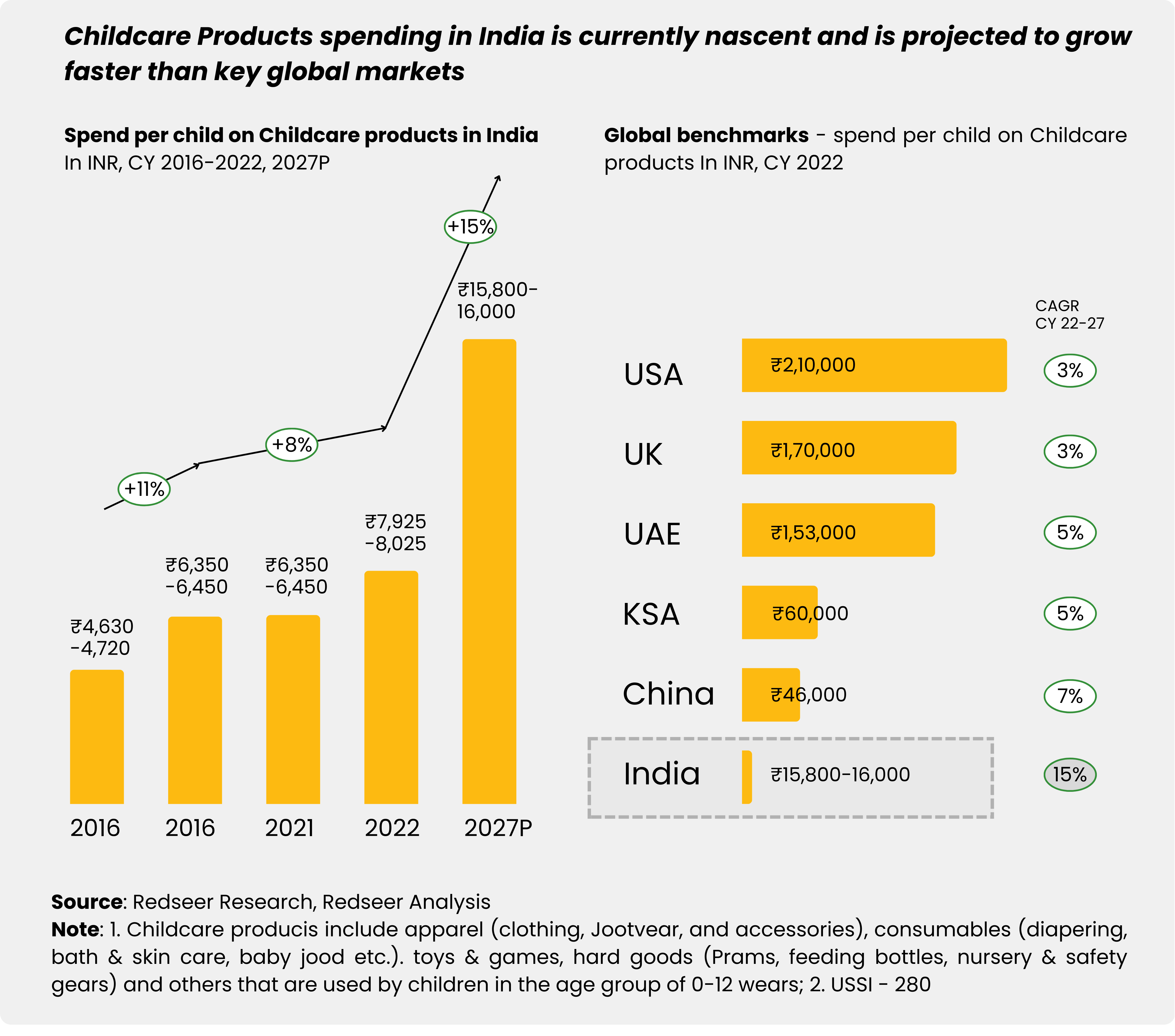

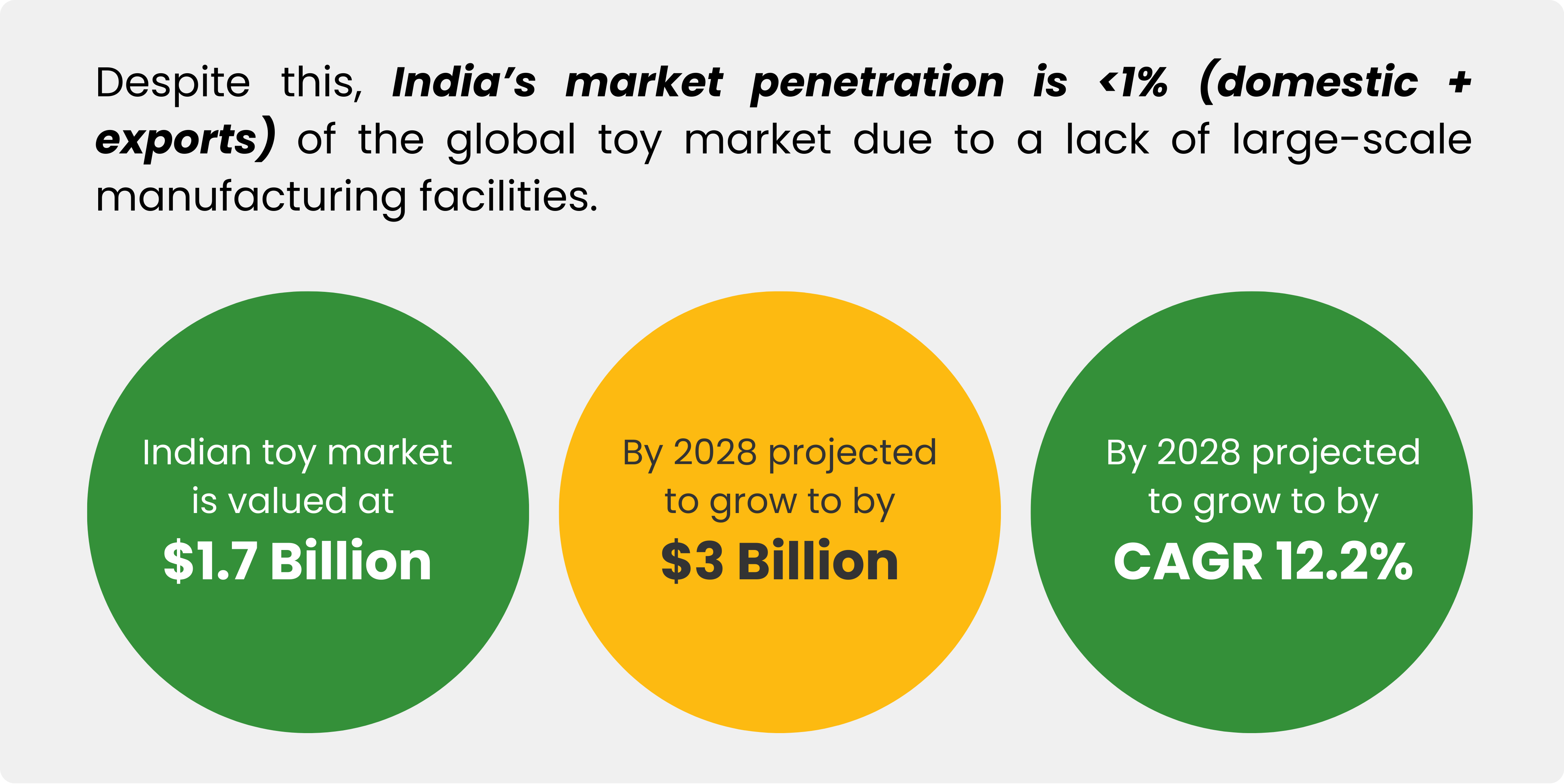

There are diverse toy categories — electronics, plush (soft toys), educational toys, and others (plastic/wooden toys) with different price ranges catering to different customer segments and age -groups. Toys for infant and preschool children under the age group of 0–5, constitute the largest share of total revenues in India.

From the Managing Partner's desk