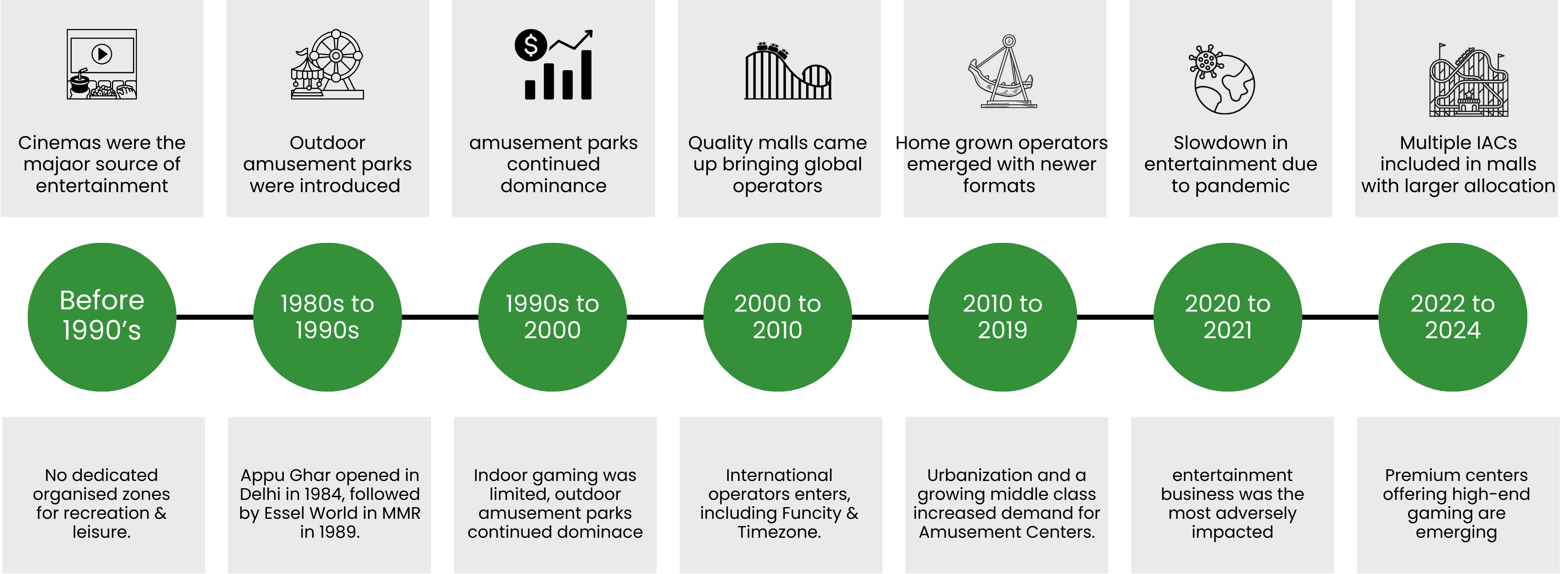

Evolutions of the Amusement Centers:

Evolution of Indian Amusement Centers

Drivers of Growth

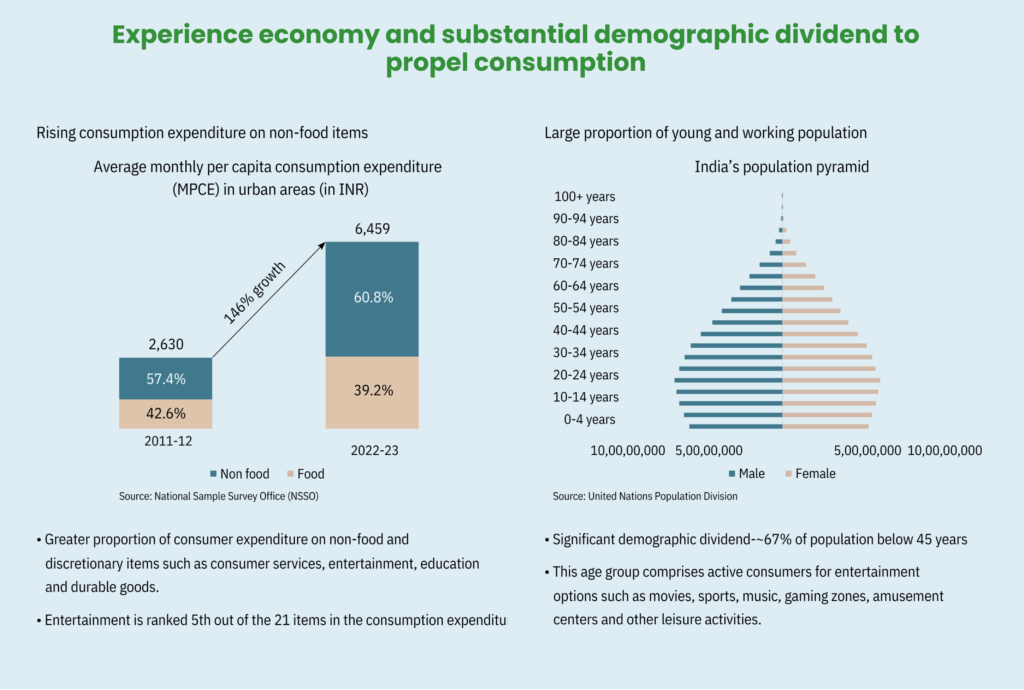

Experience Economy: The sources highlight a cultural shift where consumers are prioritising experiences over products. They seek unique and immersive experiences, driving demand for retail destinations that serve as social meeting places.

Demographic Dividend: With a significant youth population, India presents a massive market for entertainment options. Approximately 67% of the population is below 45 years old, comprising active consumers for entertainment offerings like movies, sports, music, gaming zones, amusement centers, and other leisure activities.

Rising Consumption Expenditure: An increase in consumer spending on non-food and discretionary items, including entertainment, is significantly contributing to market growth. Entertainment is ranked 5th out of the 21 items in the consumption expenditure.

Urban Space Revitalisation: Government initiatives aimed at enhancing public spaces are creating opportunities for entertainment operators. These projects are attracting businesses, improving public spaces, and boosting tourism. Examples include the Sabarmati Riverfront Development in Ahmedabad and the Chambal Riverfront Restoration in Kota.

Market Evolution and Trends

The following trends highlight this market evolution:

From Arcades to Large-scale Centers: The journey began with small-scale gaming arcades in neighbourhood markets, evolving into premium bowling alleys, and eventually encompassing diverse entertainment concepts within expansive malls.

Premiumisation: Operators are investing in larger, more diverse facilities to cater to the growing demand for premium experiences. High-end gaming equipment, luxurious lounges, and immersive attractions are becoming increasingly common.

Clustering: Operators are open to co-existing within malls and entertainment complexes, creating clusters that offer a variety of options for different age groups. This collaborative approach enhances the overall entertainment experience and attracts a wider consumer base.

Strategic Integration: Entertainment is now considered an integral component of retail developments, driving foot traffic and enhancing the overall appeal. Developers are strategically allocating space for entertainment zones to create a more holistic and engaging consumer experience.

Focus on Compliant Spaces: Organised entertainment operators are prioritising visitor safety, leading to a demand for fully compliant and high-quality spaces. This trend favours malls and necessitates upgrades to standalone complexes to meet safety standards.

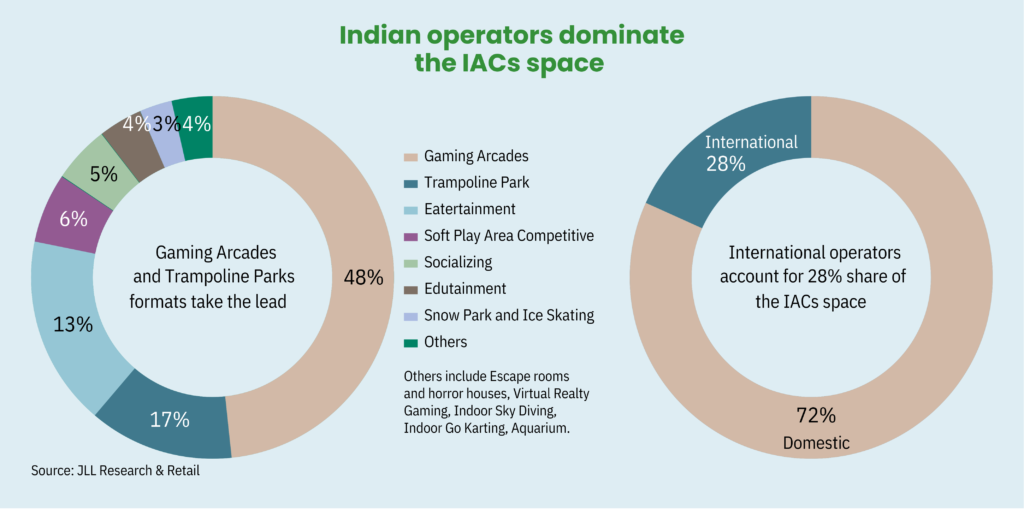

Rise of Domestic Operators: Indian operators are playing a crucial role in shaping the market, introducing premium formats and adapting global concepts to local preferences. This indicates a growing maturity and innovation within the Indian entertainment industry.

Consumer Profile

Key consumer segments include:

Families: IACs offer a family-friendly environment where parents and children can engage in various activities together. This makes them attractive destinations for weekend outings, birthday celebrations, and family gatherings.

Millennials and Gen Z: These tech-savvy generations are drawn to the immersive and interactive experiences offered by VR gaming zones, escape rooms, and competitive socialising centers. They are key drivers of the demand for innovative and engaging entertainment formats.

Corporate Groups: IACs are increasingly becoming venues for corporate events, team-building activities, and social gatherings. Eatertainment centers and competitive socialising venues are particularly popular for such occasions.

Tourists: As tourism grows, IACs are attracting both domestic and international tourists seeking entertainment and leisure options. The development of world-class amusement parks and entertainment hubs is contributing to this trend.

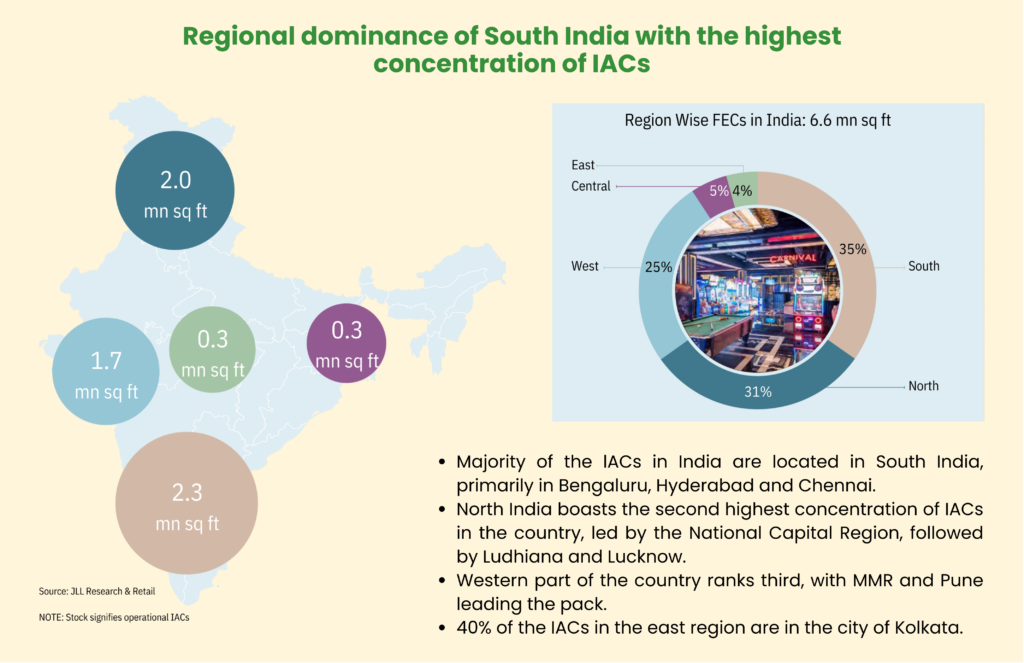

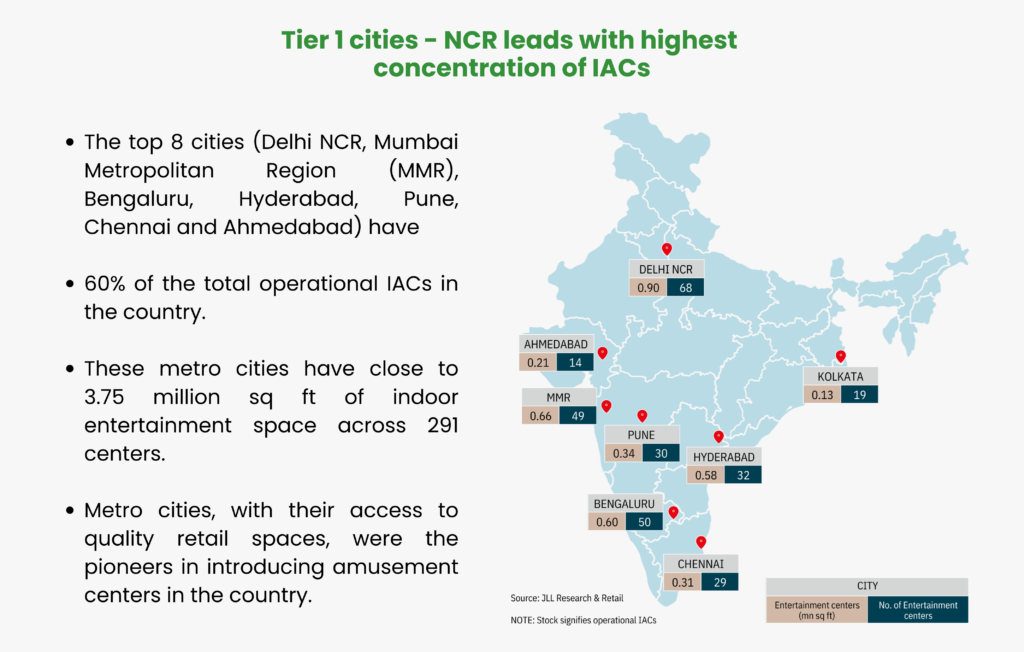

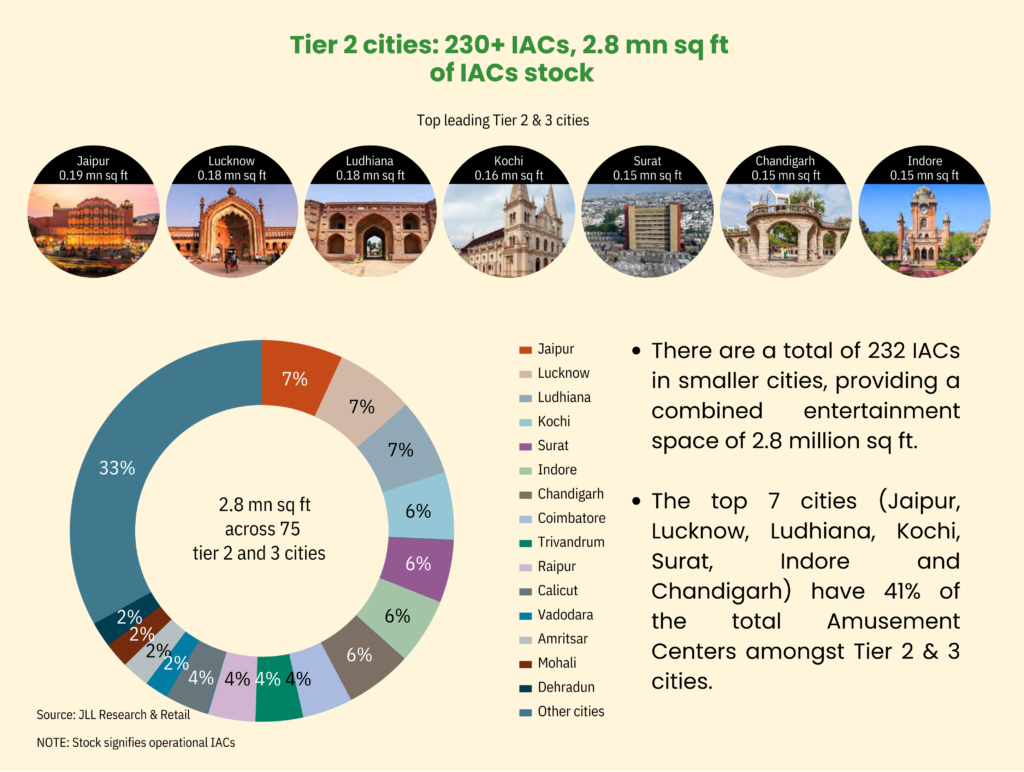

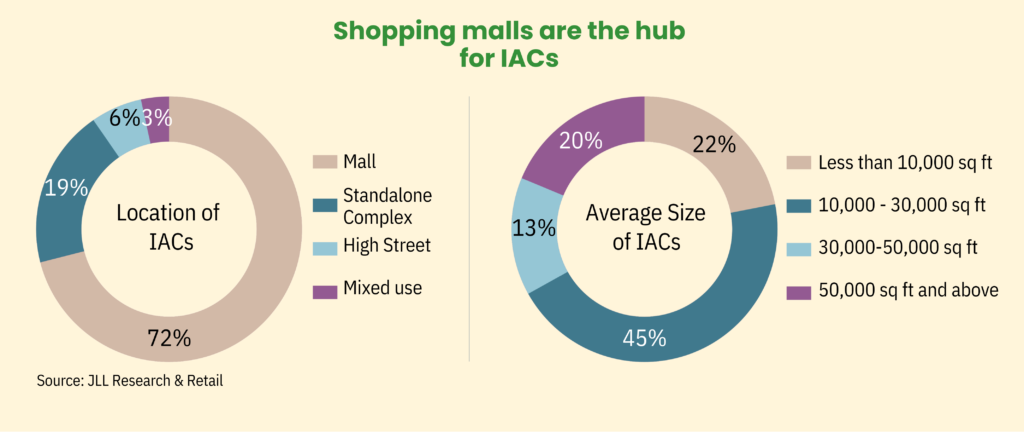

Geographic distribution:

Category split and operator split:

Market Opportunity:

Key factors supporting this claim include:

Untapped Potential: With a projected growth from INR 4,350 crore to INR 9,218 crore in annual revenues by 2030, the market is still developing and offers substantial room for expansion.

Increasing Mall Space: The anticipated addition of over 56 mn sq ft of Grade A mall space by 2028, with 6-8% typically designated for entertainment, indicates a significant pipeline for new IACs.

Demand in Tier 2 and 3 Cities: As consumer demand rises in smaller cities, operators are expanding into these markets with large-sized centers, capitalising on competitive real estate rentals and the lack of quality entertainment options.

Government Initiatives: Government focus on enhancing public spaces and promoting tourism is creating a favourable environment for the growth of the entertainment sector.

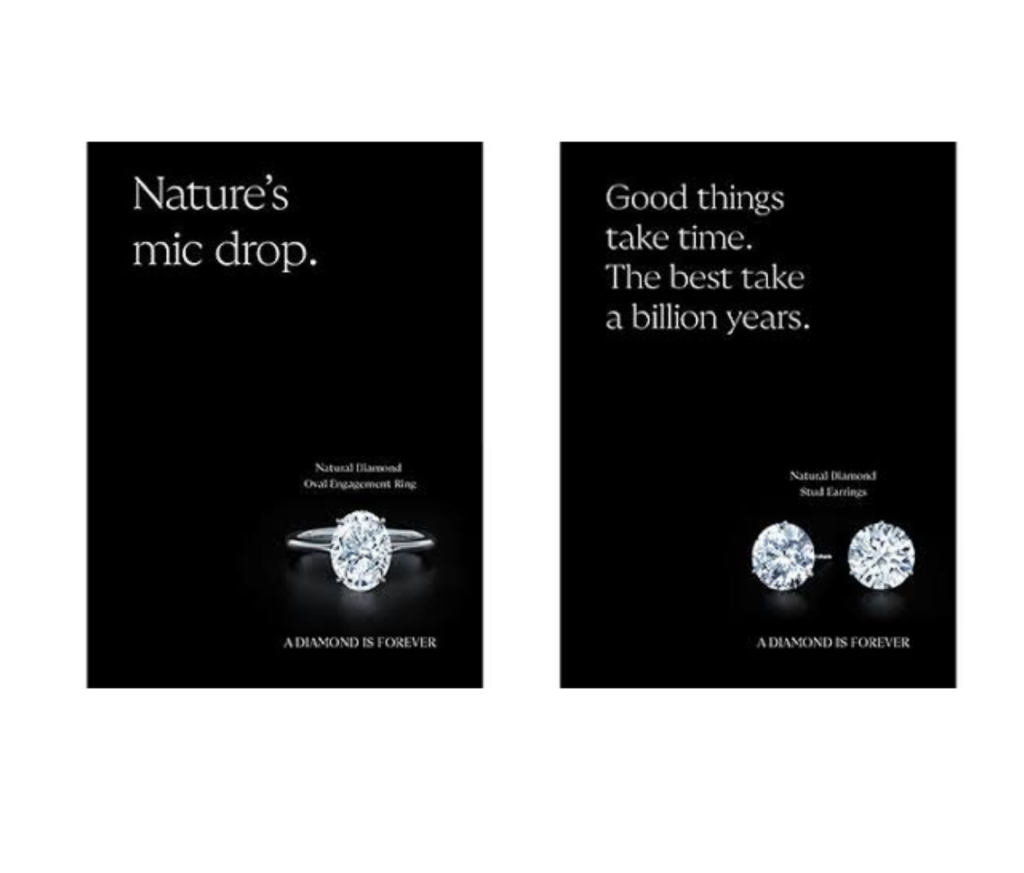

Origins of the hoax: The De Beers diamond hoax began in the early 20th century when De Beers, facing a decline in diamond demand, sought to create artificial scarcity and elevate the perceived value of diamonds through strategic marketing efforts.

The “A Diamond is Forever” campaign: Launched in 1947, this iconic campaign linked diamonds to love and commitment, promoting the idea that a diamond engagement ring was essential for marriage proposals. This messaging significantly influenced consumer behaviour.

Increased demand: The campaign dramatically increased the percentage of brides receiving diamond engagement rings, from about 10% in the 1930s to over 80% by the end of the 20th century, solidifying diamonds as a cultural norm.

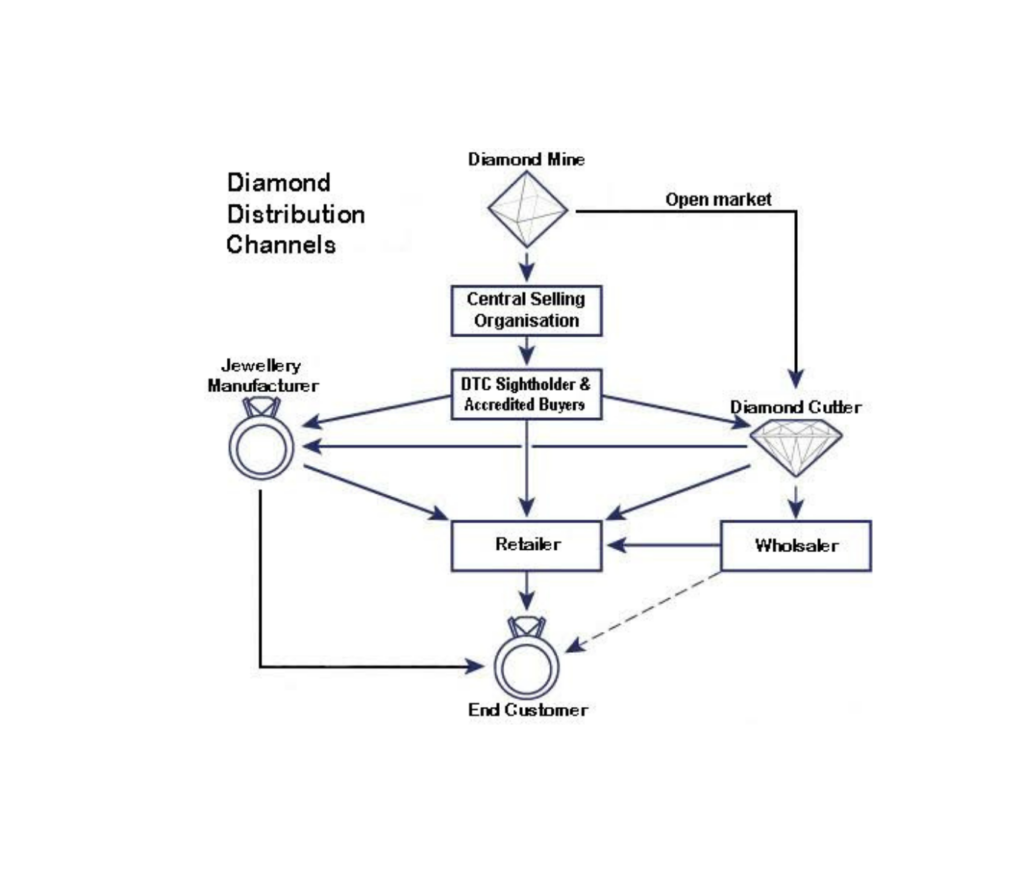

Market control and high prices: By controlling the supply of diamonds and creating an artificial demand, De Beers maintained high prices and significant profits, effectively monopolizing the diamond trade for decades.

Ethical concerns: The hoax has faced criticism for market manipulation, including accusations of dealing in conflict diamonds linked to human rights abuses and environmental degradation from diamond mining practices.

Cultural impact: The De Beers diamond hoax not only reshaped consumer perceptions of diamonds but also inspired similar marketing strategies across various industries, highlighting the power of advertising in creating demand for products.

Market Opportunity

Lab grown diamonds market:

- The lab-grown diamond market currently valued at approximately $22 billion, presents significant growth potential, especially when considering the overall natural diamond market, which is estimated at $100 billion.

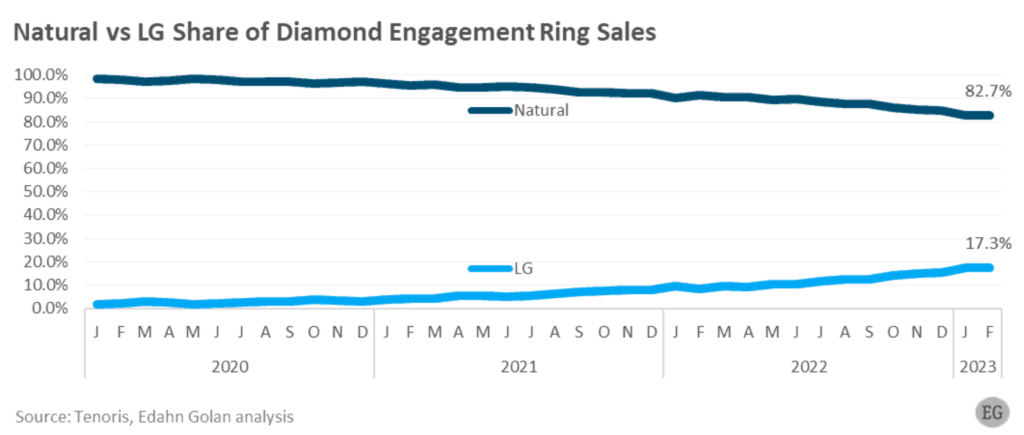

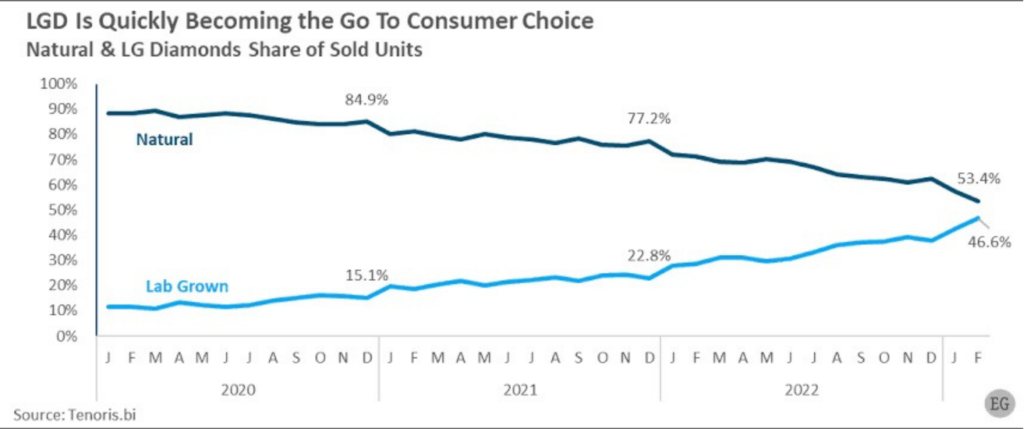

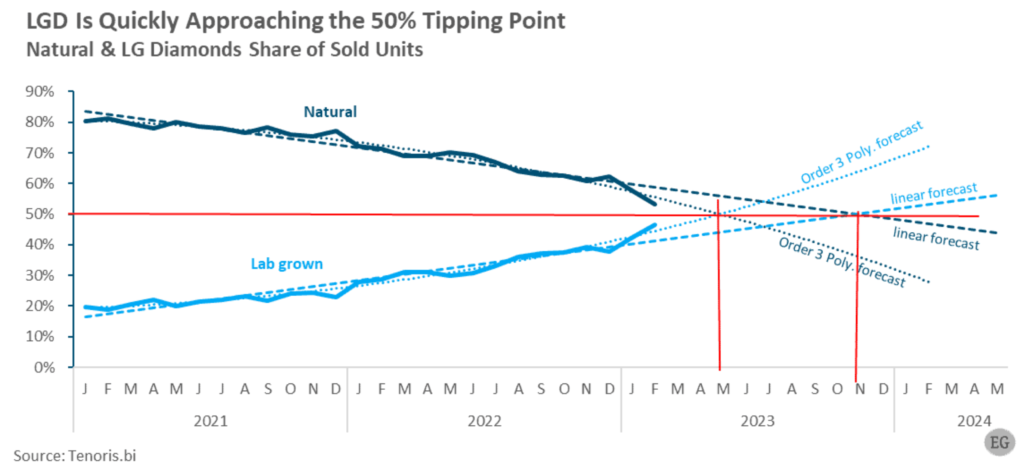

- Loose lab-grown diamond unit sales in the U.S. held a share of 13.7% in 2020, which was viewed as relatively high at the time. Since then, their share has increased to a remarkable 46.6% as of February 2023. In just three years, lab-grown diamonds moved from just above a tenth of total sales to nearly half. A similar trend is expected to replicate in India.

LGD jewellery opportunity

- India’s lab grown diamond jewellery market was valued at US$

264.5 million in 2022. Over the next ten years, lab grown diamond jewellery sales is expected to rise at 14.8% CAGR. Total market size is expected to increase from $300 million in 2023 to $1.2 billion by 2033. - Lab-grown diamond (LGD) jewellery is poised to capitalize on significant opportunities within the $22 billion bridal jewellery market and the $32 billion gifting jewellery market of India.

- Govt. of India has shown big support to the Lab Grown Diamond industry by promoting sustainability with our PM Narendra Modi gifting a 7.5 carats LGD to Joe Biden’s wife.

Government initiatives

- A grant from the Indian government to IIT: The Indian government has given a grant of INR 242 crores to IIT Madras to study lab-created diamonds. The government has approved the investment, which would be made over five years.

- Removal of 5% custom duty on diamond seeds: The government has eliminated the 5% customs duty formerly applied to the seeds used to create rough lab-made diamonds.

- Removal of the term “synthetic”: The Federal Trade Commission (FTC) and the Gemmological Institute of India (GIA) banned the use of the term “synthetic” in reference to lab created diamonds. Because lab diamonds share the same optical, physical, thermal, and chemical characteristics as natural diamonds, these two institutions now designate them as such.

- Different import codes for lab-grown diamonds and natural diamonds: Previously, whether they were man-made diamonds or natural stones, all raw synthetic gemstones imported into India had the same import code: 71042000. But now, rough lab-grown diamonds are classified as 71042010, while other rough synthetic stones are given the designation 71042090. This will help track and monitor the two types of diamonds.

Growth drivers:

Increasing aspirational buyers: As lab grown diamond brands offer competitively priced lab-grown diamond jewellery, it taps into the aspirations of middle-class consumers to own diamonds. This positions the brand for sustained success by making diamond ownership an attainable goal for a wider demographic of value-conscious consumer with growing spending power.

Increasing cost related awareness: As consumer awareness of lab-grown diamonds continues to rise, the LGD brands are well- positioned to attract new customers. The shift in consumer preferences towards sustainable and cost-effective jewellery options presents a timely opportunity for growth.

Potential for High Returns: With the rapid expansion of the lab- grown diamond market and the increasing spending power of the emerging middle class, we as investors can expect substantial returns as the new age LGD brandscapture market share in this burgeoning industry.

What to Look for When Buying:

- Certification: Ensure your lab-grown diamond is certified by reputable gemmological laboratories like the GIA or IGI.

- The 4Cs: Just like mined diamonds, lab-grown diamonds are graded based on the 4Cs: Cut, Clarity, Colour, and Carat.

- Retailer Reputation: Choose a reputable jeweller who is transparent about their lab-grown diamond sourcing and knowledgeable about their products.

From the Managing Partner's desk