Market Overview: The global battery market, valued at USD 139.36 billion in 2024, is projected to grow at a CAGR of 15.20% over the next eight years. With the Asia-Pacific region poised to dominate this expansion, we see unprecedented opportunities emerging in this sector, particularly in lithium-ion technology—the fastest- growing cell chemistry due to its superior energy density and versatile applications across electric vehicles, consumer electronics, and energy storage systems.

Understanding Battery Technology:

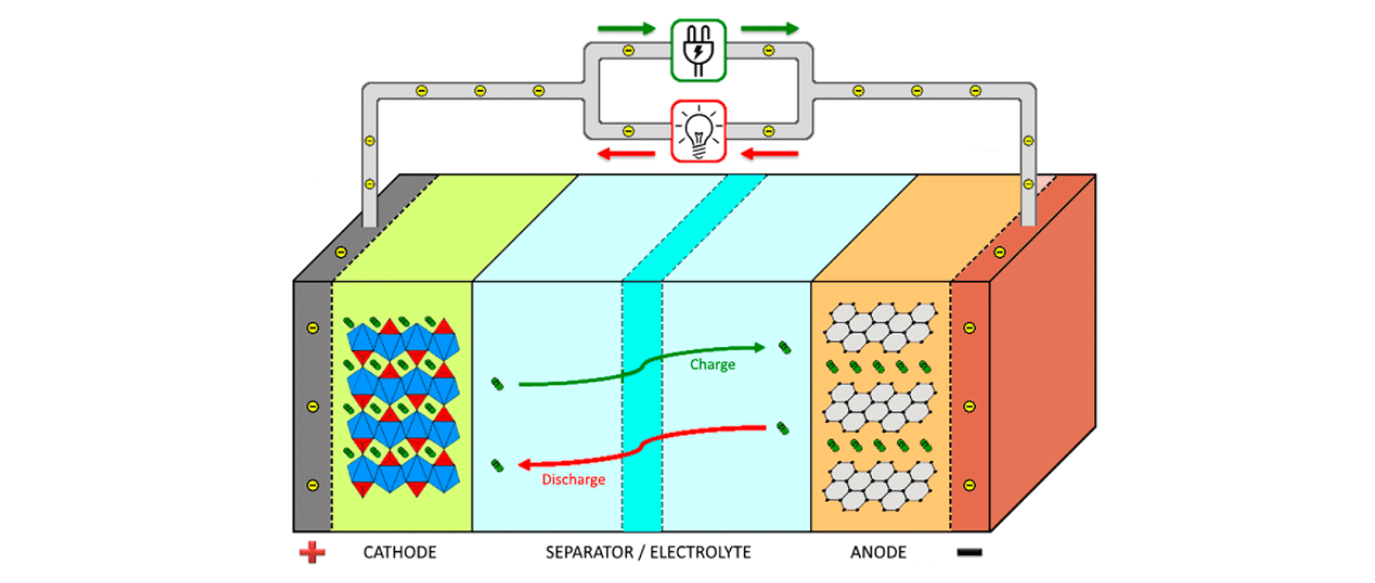

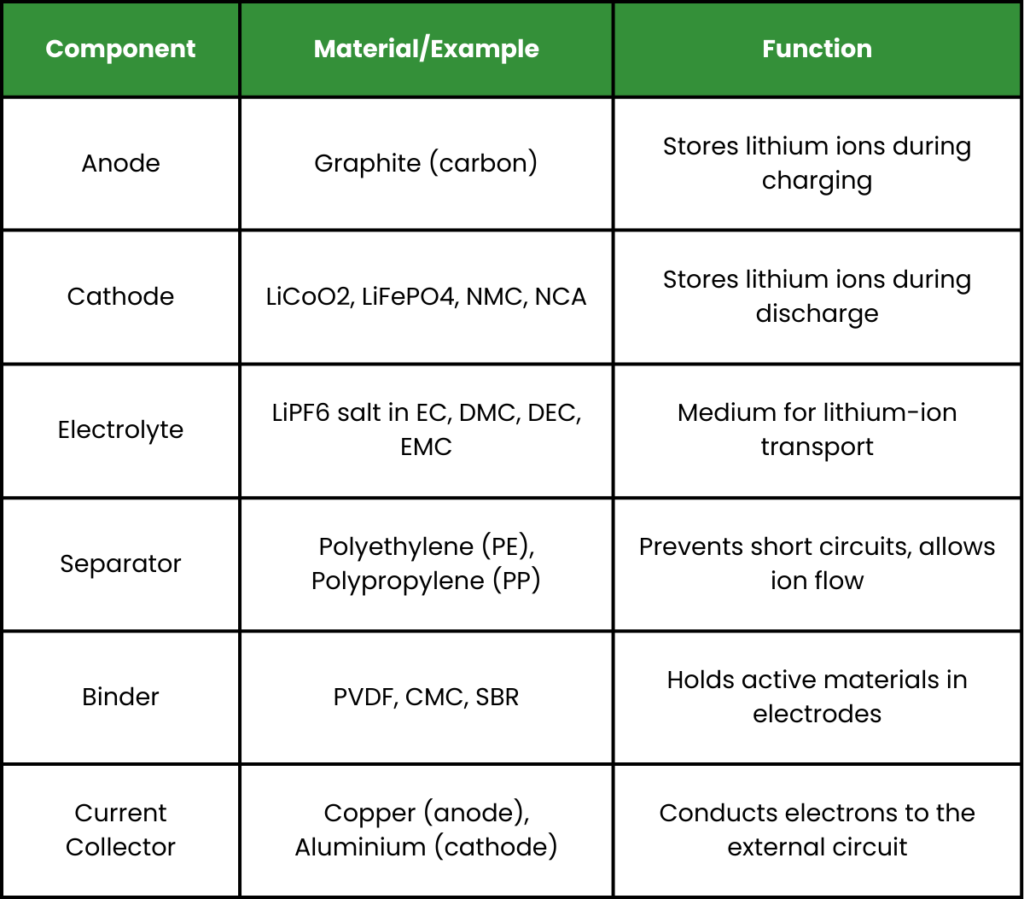

At its core, a battery converts chemical energy into electrical energy through a sophisticated interplay of components. Each battery comprises cells containing:

- A positive electrode (cathode)

- A negative electrode (anode)

- An electrolyte solution

- A separator

Functions of different components of a cell:

Evolution of batteries:

1859

Lead-acid battery, the oldest form of rechargeable battery was invented.

1866

First dry-cell, Leclanche battery made of Zinc-Carbon was manufactured.

1899

The first alkaline battery with higher energy density, the Ni-Cd battery was invented.

1960s

Alkaline batteries replace Zn-C batteries supplying greater energy at high current.

And finally,

1991

The first Li-ion battery prototype was commercialized by Sony

Why Lithium-Ion Dominates:

- Superior Energy Density: 240 Wh/Kg at cell level

- Extended Lifecycle: 500-1,000 cycles at 50% Depth of Discharge

- Minimal Self-Discharge: Only 1.5-2% per month

- Rapid Charging Capabilities

The LFP Opportunity:

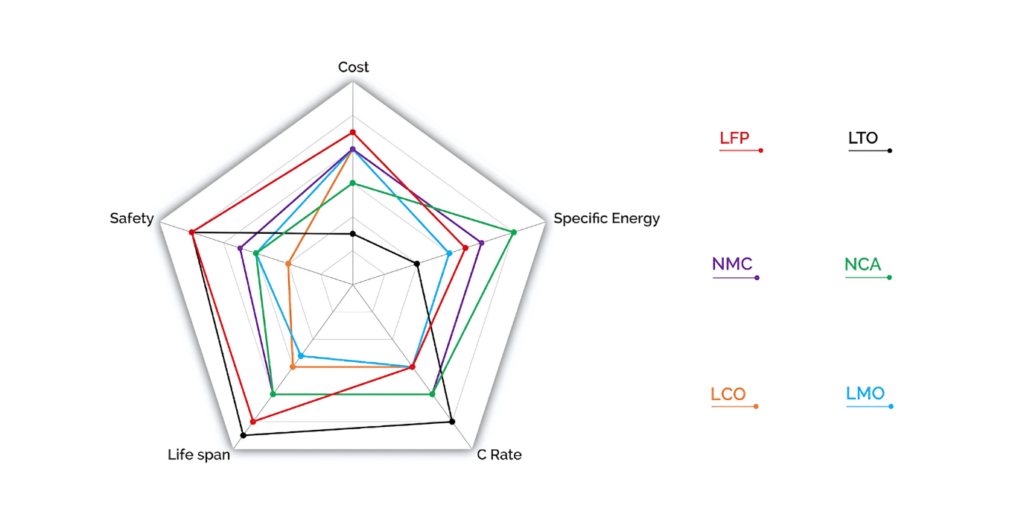

Key Performance Metrics:

When evaluating battery technologies, we focus on:

- Specific Energy (Wh/Kg): Energy-to-weight ratio

- Safety & Thermal Stability: Critical for commercial viability

- C-Rate: Charge/discharge capabilities

- Lifecycle Performance: Longevity and capacity retention

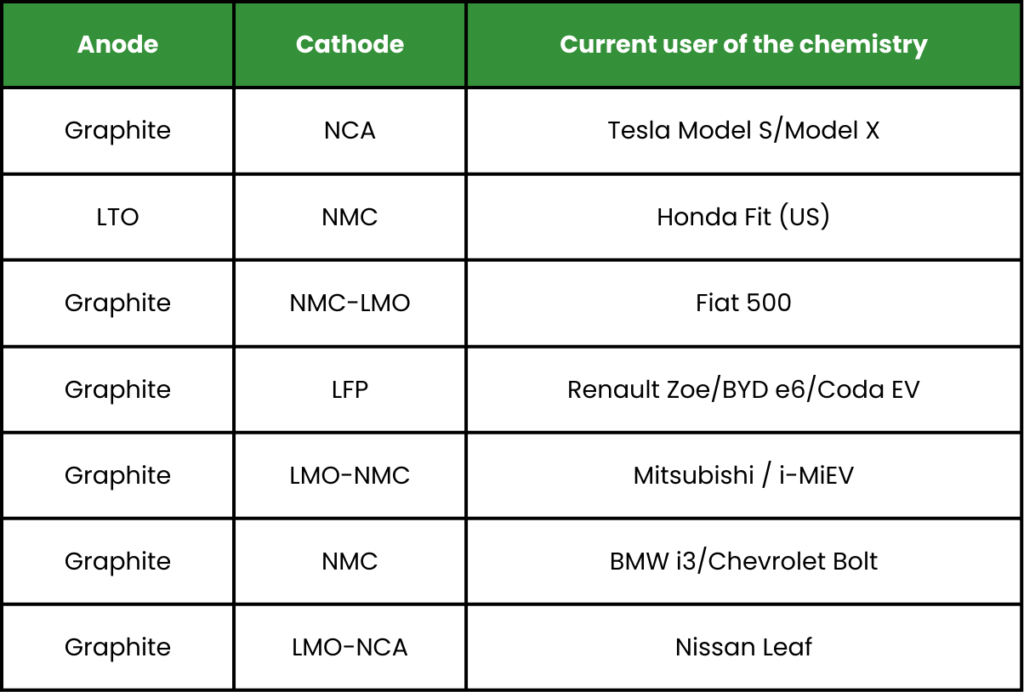

Use-Cases in EVs for various Lithium-Ion Chemistries

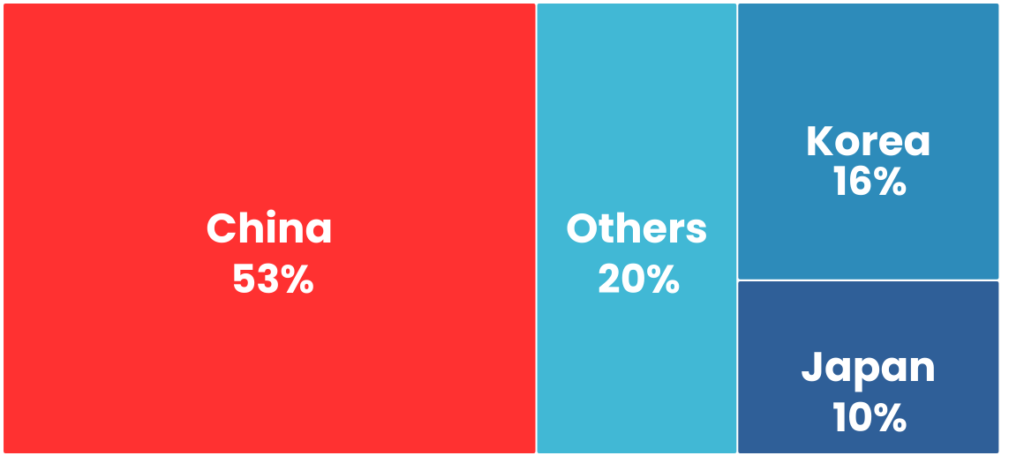

China Dominance:

Current Battery Manufacturing Landscape in India:

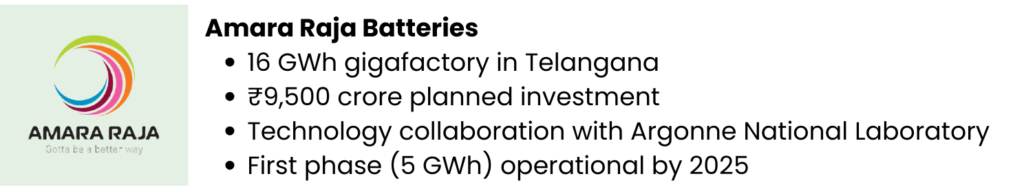

Established Leaders:

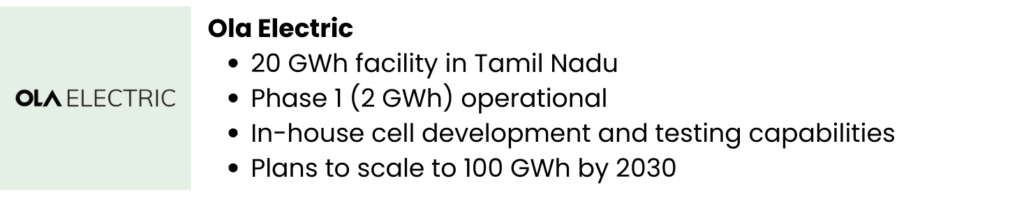

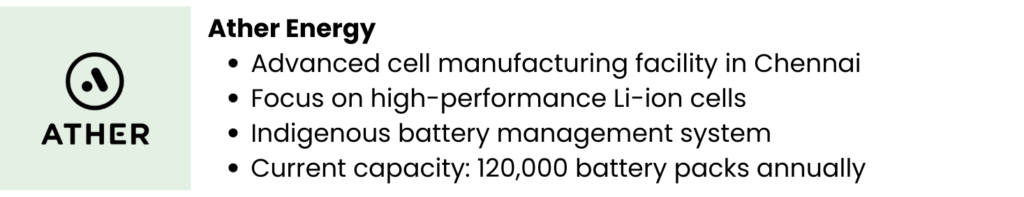

New Age Players:

Other Significant Developments:

The combined planned capacity of these players is expected to exceed 70 GWh by 2027, positioning India to capture approximately 10% of the global battery manufacturing market.

Economic Potential in India:

Exide Industries

- 12 GWh plant under construction in Karnataka

- ₹6,000 crore investment in Phase 1

- Partnership with SVOLT Energy for technology

- Expected completion: 2024-25

The Indian battery sector presents compelling investment opportunities:

- Required Investment: >$10 billion by 2030 for Li-ion cell manufacturing

- Job Creation: Projected 1+ million new positions in manufacturing and allied sectors

- Strategic Position: Emerging as a potential global export hub

From the Managing Partner's desk