The quantum computing sector is abuzz with potential. It leverages the mind-bending principles of quantum mechanics to solve problems intractable for even the mightiest classical computers.

Here's a quick glimpse

The Gimmick: Qubits, unlike classical bits (0 or 1), can be in a state of superposition (both 0 and 1 at once). This, along with entanglement (linked qubits sharing an instant connection), unlocks immense processing power.

The Promise: Revolutionizing fields like drug discovery, materials science, artificial intelligence, and financial modelling by tackling problems previously deemed impossible .

The Reality: Still early days. Quantum computers are complex, expensive, and prone to errors. However, rapid advancements are being made.

The Future: The road ahead is filled with challenges, but the potential rewards are immense. As the technology matures, quantum computing has the potential to become a game-changer across industries, ushering in a new era of computational power.

Why we're Excited about Quantum Computing

The world of computing is on the verge of a paradigm shift. Quantum computing, once relegated to the realm of science fiction, is rapidly evolving into a reality with the potential to disrupt numerous industries. Here’s why we are excited about this ground breaking technology:

Untapped Potential: Classical computers are reaching their limits. Quantum computers, by harnessing the bizarre properties of quantum mechanics, can tackle problems beyond the reach of even the most powerful supercomputers. This opens doors to ground breaking discoveries in drug discovery, materials science, artificial intelligence, and financial modelling — sectors with massive commercial potential.

First-Mover Advantage: The quantum computing race is on, and early investment can secure a significant advantage. By backing promising startups in this nascent field, we can position ourselves at the forefront of a technological revolution. Imagine the potential returns for the fund that identify the next Google or Amazon of quantum computing!

Diversification & Innovation: Quantum computing presents a unique opportunity to diversify our portfolio beyond traditional tech investments. This sector offers a high-risk, high-reward proposition that can significantly boost returns if the technology matures as expected.

Beyond the Hype: While challenges remain (hardware complexity, error correction), the field is experiencing rapid advancements.Governments and major tech companies are pouring resources into research, accelerating progress toward a commercially viable quantum computer.

Investing in the Future: Quantum computing isn’t just about faster calculations. It’s about solving previously unsolvable problems. By supporting this technology, we are not just making an investment, we are investing in a future filled with ground breaking discoveries and innovations that will shape the world for decades to come.

The Bottom Line: The quantum computing sector offers a unique blend of high risk and potentially exponential rewards. Forward-thinking VC funds that seize this opportunity stand to gain a significant edge in the race for the future of technology.

The Market and the Potential

A year of strong funding coupled with sturdy underlying fundamentals and significant technological advances reflected strong momentum in quantum technology (QT).

Updated McKinsey analysis for the third annual Quantum Technology Monitor reveals that four sectors: chemicals, life sciences, finance, and mobility are likely to see the earliest impact from quantum computing and could gain up to $2 trillion by 2035.

In 2023, $1.71 billion was invested in QT start-ups, which represents a 27 percent decrease from the all-time high of $2.35 billion in 2022.Nonetheless, the decrease is smaller when compared to the 38 percent decrease for all start-ups globally. The slowdown in the number of new QT start-ups founded continues (13 in 2023 versus 23 in 2022). Deal sizes have decreased as well, with the average deal size being $40 million in 2023 compared to $105 million in 2022 and $107 million in 2021. In line with this development, deal counts dropped to 171 in 2023 from 206 in 2022.

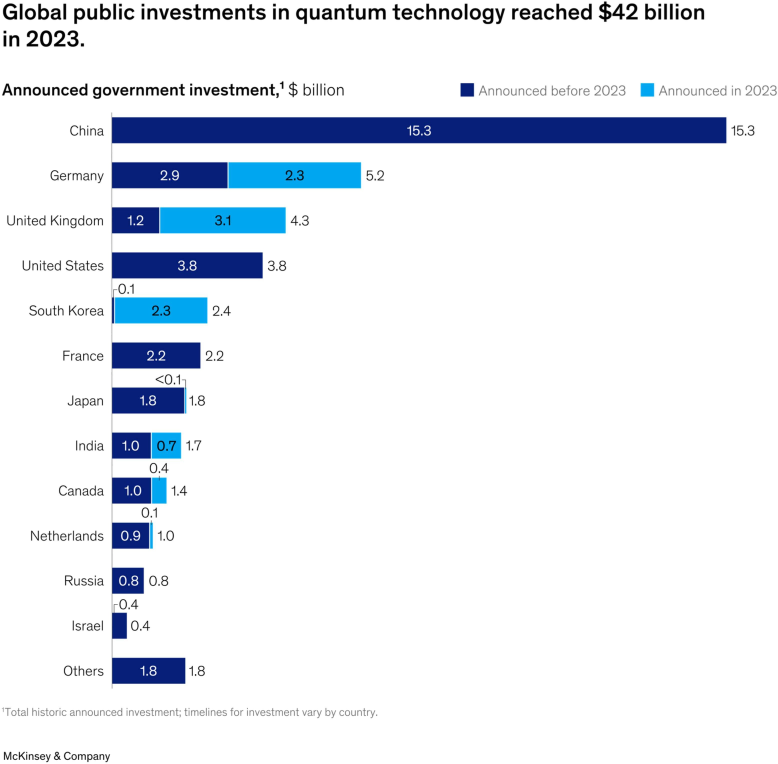

In contrast to the private sector, public investments increased more than 50 percent over 2022, making up almost a third of all investments in quantum technology. A range of countries, led by Germany, the United Kingdom, and South Korea, have announced significant new funding for QT development, bringing the global public funding total to date to about $42 billion.

While China and the United States have previously dominated QT public investment, new announcements from Australia, Canada, Germany, India, Japan, the Netherlands, South Korea, and the United Kingdom reflected a growing realization among a broader range of governments of the importance of QT; South Korea and the United Kingdom, in particular, made significant increases to their funding levels.

Our Investment Thesis

Stage: We’ll be entering a startup at Seed and Pre-Series A stage and we’ll back on the winners from our portfolio and invest follow on capital till Series C.

Geography: We will be focusing on startups based in India and building solutions for global markets as well.

Business Model: Some prevalent and successful business models that we will look for are:

Quantum as a service (QaaS): Use quantum computers remotely (“in the cloud”) instead of buying and maintaining them yourself. e.g. providing access to quantum servers through classical computers.

Software and algorithms: Develop software and algorithms specifically designed for quantum computers. e.g. Quantum security protocols based on QKD

Industry specific solutions: Focus on applying quantum computing to specific industries or applications. e.g. providing simulation services based on quantum information science.

Hardware: Building and selling improved quantum computers. e.g. creating fault tolerant quantum computers with higher number of qubits.

Investment Size: Typical check size for entry in any Startup would be from 1 crore to 4 Crore. And for follow on capital the check size will go up to 25 crore for Series C portfolio startups.

Evaluation Metrics: Some key metrics specific to Quantum computing startups which we’ll look for are:

Team expertise in terms of technical depth and advisory board strength, technological progress and milestones achieved, GTM strategy, IP portfolio, burn rate and future roadmap.

From our Angel Fund Portfolio

We are incredibly proud of our portfolio company QpiAI which is solving the challenges of complex data and large models with vertical integration of AI and Quantum Computing today. QpiAI is developing solutions for discovering the most optimal AI and Quantum systems in Life sciences, Healthcare, Transportation, Finance, Industrial, Space technologies and deploying them at the speed of light. QpiAI is well supported by other Qpi Technology subsidiaries, Qpicloud which is pioneering next gen Quantum and AI cloud computing and SuperQ which is into next gen superconductivity based products such as motors, single photon detectors, high temperature qubits, material discovery using Quantum and AI based discovery engine. Qpivolta is a premium battery design and manufacturing company with focus on next generation solid state batteries based on Quantum and AI simulation, synthesis and manufacturing technology.

In the news

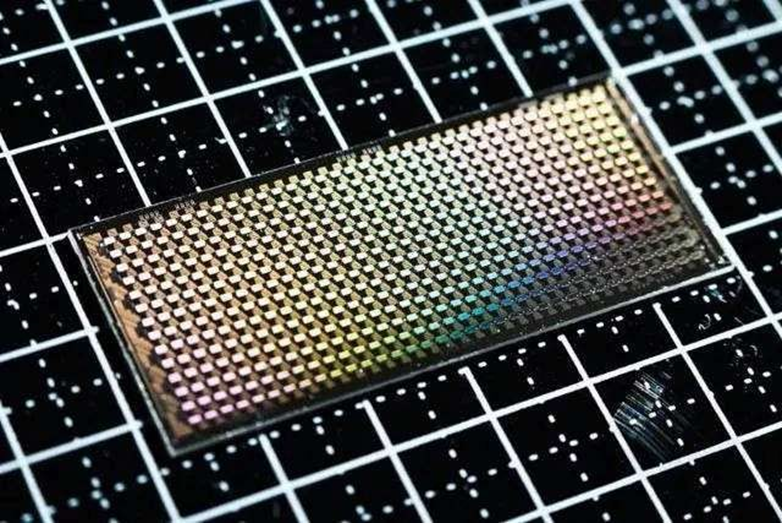

China has recently launched 504-qubit quantum chip which is open to global users. Click here to read the complete article

University of Vienna has achieved a significant breakthrough in quantum technology, with the successful demonstration of quantum interference among several single photons using a novel resource-efficient platform. Click here to read the complete article

From the Managing Partner's desk

Gaurav VK Singhvi, Managing Partner, Avinya VC

Quantum computing presents a once-in-a-generation opportunity. By investing in this nascent sector, we are not just placing a bet on a technological marvel, we are investing in the potential to revolutionize entire industries and unlock a future of unimaginable possibilities. The road ahead may have its hurdles, but the potential rewards — from ground breaking scientific discoveries to market domination — make quantum computing a prospect no forward-thinking VC fund can afford to ignore. Partnering with the brilliant minds shaping this technology can propel your portfolio to the forefront of the coming quantum revolution.