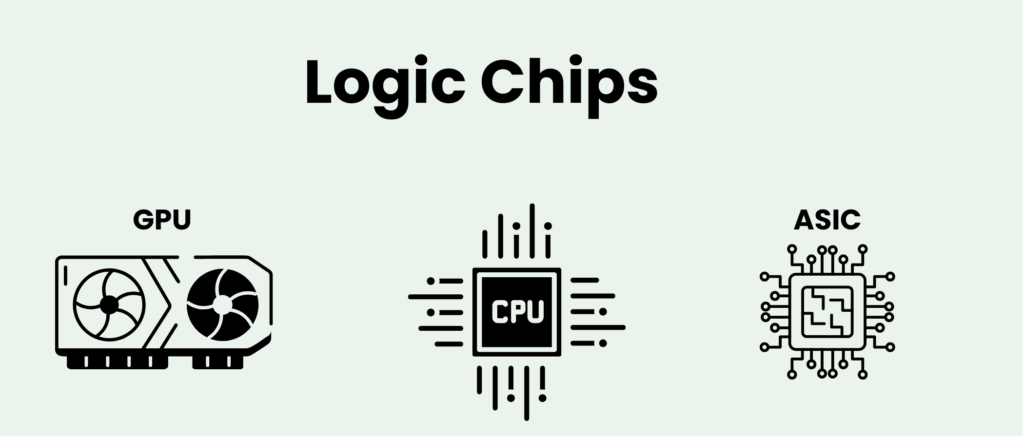

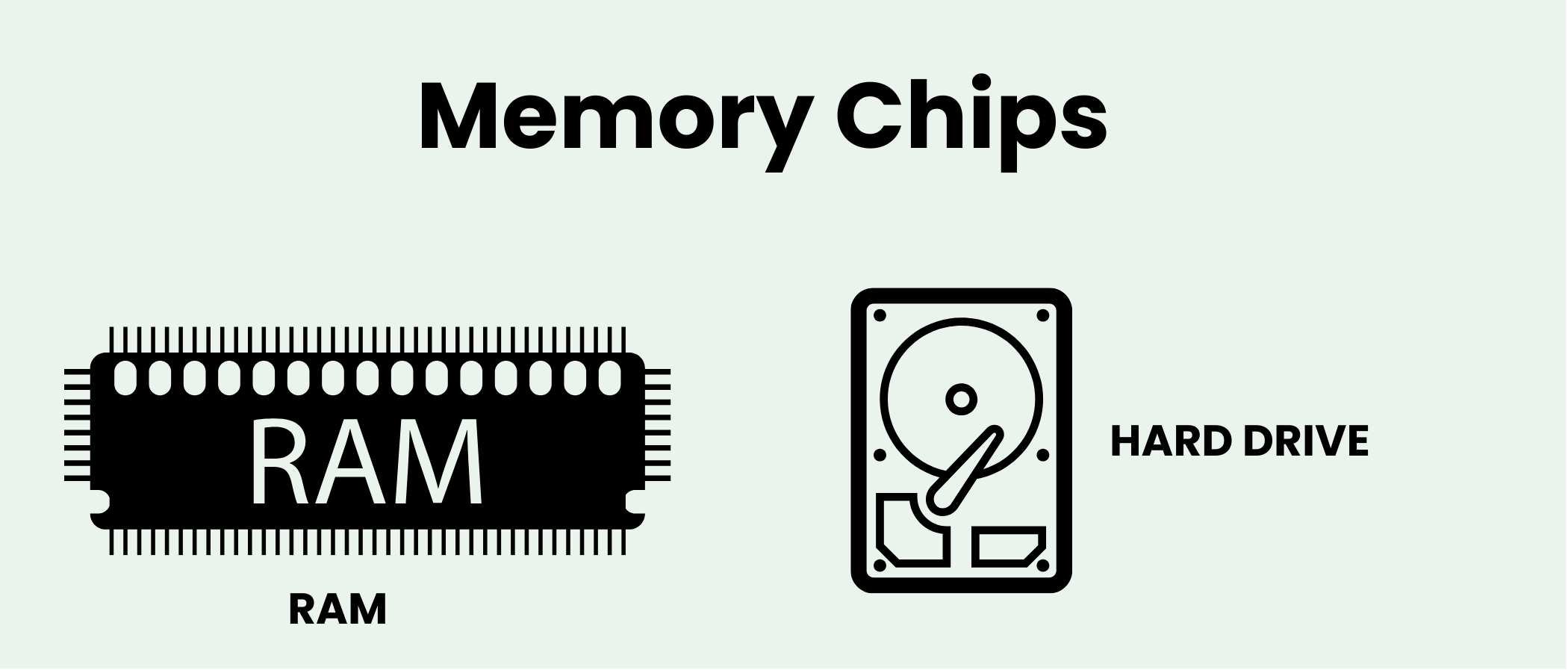

Semiconductors are broadly classified into two major categories:

These store data, either temporarily (DRAM) or permanently (NAND or flash memory). DRAM chips use electric currents to store 1s and 0s, while NAND flash is used for longer-term data storage

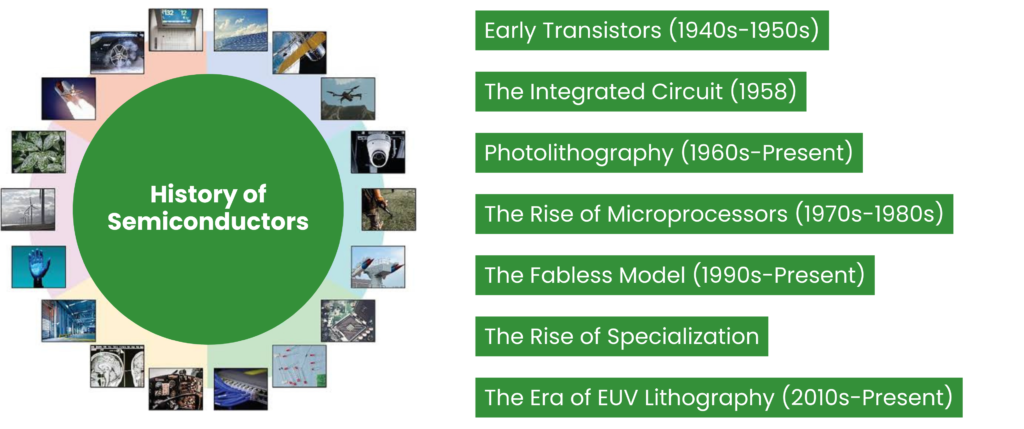

A Historical Perspective: A Story of Relentless Innovation

A Historical Perspective: A Story of Relentless Innovation

Early Transistors (1940s-1950s): The invention of the transistor at Bell Labs marked the beginning of the semiconductor revolution, replacing bulky and inefficient vacuum tubes.

The Integrated Circuit (1958): Jack Kilby of Texas Instruments and Robert Noyce of Fairchild Semiconductor independently developed the integrated circuit, which combined multiple transistors on a single chip, significantly reducing size and cost.

Photolithography (1960s-Present): The development of photolithography by Jay Lathrop was key to mass production. This technique uses light to print patterns on semiconductor wafers, creating intricate circuits. Over the years, it has evolved from using simple visible light to ultraviolet and extreme ultraviolet (EUV) light, to carve increasingly smaller features.

The Rise of Microprocessors (1970s-1980s): Companies like Intel introduced the first microprocessors, enabling the development of personal computers and revolutionizing the industry.

The Fabless Model (1990s-Present): The emergence of fabless chip design firms like Chips and Technologies, and dedicated foundries like TSMC, separated design from manufacturing, fostering innovation and reducing barriers to entry. This has allowed smaller companies to focus on design, and larger companies to have their chips manufactured externally.

The Rise of Specialization: The increasing complexity of chip manufacturing has driven specialization and the development of a global supply chain, involving dedicated companies focused on materials, manufacturing equipment, and assembly.

The Era of EUV Lithography (2010s-Present): The development of EUV lithography, with a wavelength of 13.5 nanometers, has enabled the creation of extremely small and powerful transistors.

The Evolving Landscape:

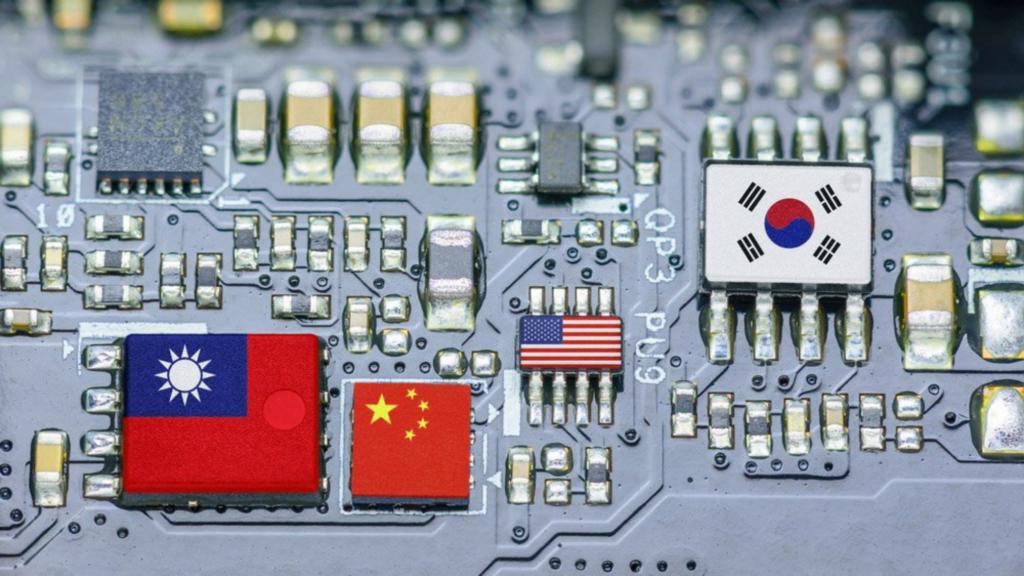

Geopolitical Tensions: As chips become critical for economic and military power, governments are increasingly trying to control the semiconductor supply chain.

The Importance of Manufacturing: While design is critical, the ability to mass produce chips is equally important. Foundries like TSMC and Samsung have become critical players, due to the high cost and complexity of semiconductor manufacturing.

The Rise of AI and ML: The increasing demand for Artificial Intelligence (AI) and Machine Learning (ML) is pushing the development of specialized chips with high-performance computing power.

The End of Moore’s Law: While Moore’s law, which predicted that the number of transistors on a chip would double every two years, continues to drive progress, the industry is now exploring new architectures like 3D transistors (FinFETs) to continue improving performance.

Open-Source Architectures: The adoption of open-source architectures like RISC-V offers alternatives to proprietary designs and fosters innovation.

The Impact of Globalisation: The semiconductor industry is highly globalised, with companies relying on complex supply chains that stretch across multiple countries and a small disruption in any one country can impact the entire value chain.

Increased complexity of Chip Design and Production: The complexity of both chip design and fabrication is increasing and is creating greater opportunities for specialization in the industry, and increasing the barriers to entry for new companies.

Market Size and Key Players:

Some of the key players include:

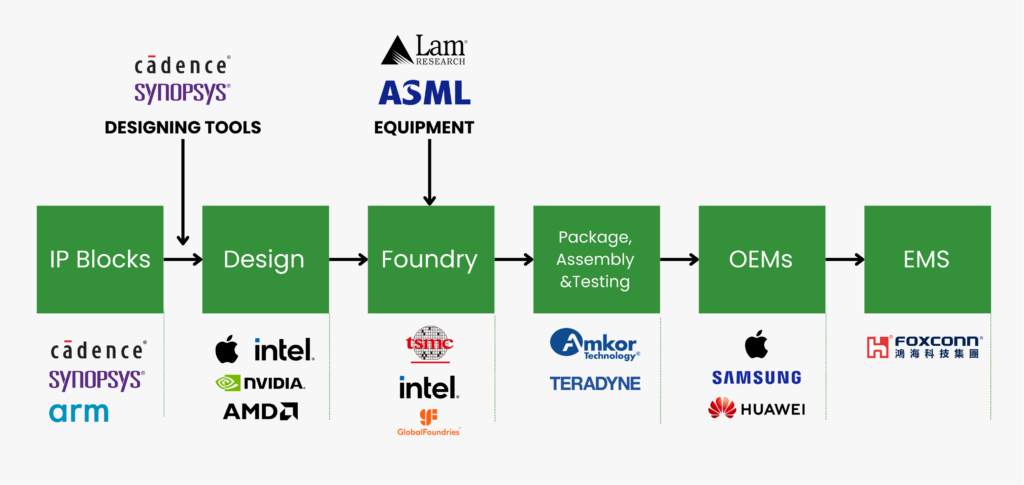

Value Chain: A Complex and Global Ecosystem

The semiconductor value chain is intricate and global, involving numerous specialized players

Design: Companies that design chips, including both fabless design houses and integrated device manufacturers (IDMs).

Manufacturing: Foundries that fabricate chips, using advanced lithography and other manufacturing techniques.

Equipment: Companies that develop and manufacture specialized equipment for chip fabrication, such as lithography machines, deposition systems, and etching tools.

Materials: Companies that supply raw materials, chemicals, and gases used in semiconductor manufacturing.

Assembly and Testing: Facilities that package and test the finished chips to ensure quality and performance.

Software: Companies that develop the software tools required for chip design.

Emerging Opportunities for Indian Startups: A New Dawn

Category split and operator split:

Skilled Talent Pool: India now possesses a vast and maturing talent pool of design engineers, with experience in cutting-edge semiconductor R&D, many of whom work at the top global semiconductor companies.

Government Incentives: The Indian government has introduced initiatives like the Design Linked Incentive (DLI) scheme and other policies aimed at attracting investment and fostering domestic manufacturing. These schemes have reduced the capital needed for startups to reach the revenue stage.

Domestic Market Growth: The Indian semiconductor market is projected to reach $60 billion by 2026, signalling huge opportunities for local players to meet the demands of the domestic market. Currently, most of this demand is met by imports, meaning that there is also potential for import substitution.

RISC-V Adoption: The open-source RISC-V architecture is gaining traction in India, reducing reliance on proprietary instruction sets. The Indian Institute of Technology (IIT) Madras is also developing its own microprocessor called SHAKTI based on RISC-V.

Manufacturing Capabilities: There is also potential to develop local manufacturing capabilities, particularly for mature node chips that serve a significant proportion of India’s needs.

Specific opportunities for Indian startups include:

Design services: Companies offering semiconductor design services are also an important part of the ecosystem.

What We Look For in a semiconductor startup at Avinya:

- •Strong and Defensible Intellectual Property: Unique and defensible technology that provides a strong competitive advantage.

- Experienced Management Teams: Teams with a proven track record in the semiconductor industry, especially in design, manufacturing, and supply chain.

- Clear Go-to-Market Strategy: Well-defined plans for targeting specific markets and scaling operations efficiently.

- Capital Efficiency: Ability to achieve significant milestones with relatively limited capital and a well thought through financial strategy.

- Targeted Niche Focus: Companies that are focused on high- growth sectors with significant market potential, such as EV, AI and IoT.

- Scalability: Startups that are able to meet the large domestic market demands and then expand globally.

From the Managing Partner's desk