What We Mean by Spacetech: Spacetech includes any technology used for space exploration, research, and applications. It encompasses everything from rockets and satellites to spacesuits and space robots. The spacetech sector is booming, with a projected market size of $77 billion by 2030 in India alone. This rapid growth is driven by several factors:

- Macro Trends: Increasing global internet usage, demand for Earth observation data, and a renewed focus on space exploration.

- Technological Advancements: Reusable rockets, miniaturization of satellites, and developments in artificial intelligence are making space activities cheaper and more efficient.

- Addressing Pain Points: Spacetech offers solutions for communication gaps in remote areas, improved weather monitoring, and resource management.

Overall Spacetech Market: The size of the space market is approximately $447 billion—up from $280 billion in 2010—and could grow to $1 trillion by 2030 (McKinsey & Co). The sector has raised $38 billion in total funding (led by the US at $23.8 billion; Indian startups raised $487 million). $10 billion was raised in the last two years alone. Total funding peaked in 2021 at $8.6 billion, falling to $4.1 billion in 2023. Out of the 1,797 companies in the sector, 678 (37.7%) are funded, 223 (32.9% of funded companies and 12.4% of total companies) are Series A+. There have been a total of 121 acquisitions and 35 IPOs. SpaceX is the top company with total funds raised exceeding $11 billion. The US has the highest number of spacetech companies, followed by the UK and India. The top business model last year was small launch vehicles, which raised $437 million, followed by satellite communications at $316 million and satellite propulsion at $249 million.

Why we are excited about Spacetech

The spacetech sector is no longer the realm of science fiction. Driven by powerful macrotrends, technological advancements, and a growing awareness of potential benefits, spacetech is rapidly becoming a hotbed for innovation and investment. Here’s why we are excited about this burgeoning industry:

Macro Trends Fueling Growth

- Exponential Growth in Data Demand: Global internet usage is expected to reach 6.6 billion users by 2025 [Source: Statista]. This insatiable demand for data creates a massive opportunity for constellations of small satellites to provide high-speed internet access, especially in remote and underserved regions. OneWeb, a satellite internet company, has already secured over $4 billion in funding to build its constellation [Source: OneWeb].

- Earth Needs a Watchful Eye: The global Earth observation market is expected to reach $17.6 billion by 2026 [Source: Grand View Research]. Spacetech offers advanced remote sensing capabilities that can monitor climate change, track resource depletion, and predict natural disasters. Planet Labs, a company deploying a fleet of Earth observation satellites, raised $200 million in 2022 [Source: TechCrunch].

- Space Tourism: The Final Frontier (of Profit): Space tourism and exploration are no longer just for the The global space tourism market is projected to reach $8.6 billion by 2030 [Source: Space Foundation]. Companies like Virgin Galactic and Blue Origin are developing reusable launch vehicles, significantly reducing travel costs and paving the way for a more accessible space experience.

Pain Points and Technological Solutions

- High Launch Costs: Traditionally, launching payloads into space has been prohibitively expensive. However, the advent of reusable rockets by companies like SpaceX has dramatically reduced launch This opens doors for more frequent missions and broader participation in the space economy.

- Limited Satellite Lifespan: Large, traditional satellites are expensive to build and have limited lifespans. The miniaturization of electronics allows for the development of constellations of small satellites, offering greater flexibility, redundancy, and affordability for data collection and

- Space Debris Threat: A growing number of satellites and defunct spacecraft orbiting Earth pose a collision Spacetech startups are developing solutions for debris removal and in-orbit servicing of satellites, ensuring the long-term sustainability of space activities.

Latest Developments in the Sector

- There have been 30+ significant deals between 2014 and May 2023, which have helped spacetech startups raise close to $233 million.

- On August 23, 2023, India became the first country to land a spacecraft on the unexplored south pole of the moon with Chandrayaan-3. It was a remarkable moment for Indian

- Finance Minister Nirmala Sitharaman’s Interim Budget on February 1 allocated INR 7,313.73 crore for space research and spacetech.

- This significant monetary infusion demonstrates the government’s commitment to developing India’s space exploration and technological capabilities.

Our Investment Thesis: At Avinya Ventures, we’re excited about the transformative potential of spacetech. We invest in seed to Series A startups across the spacetech landscape.

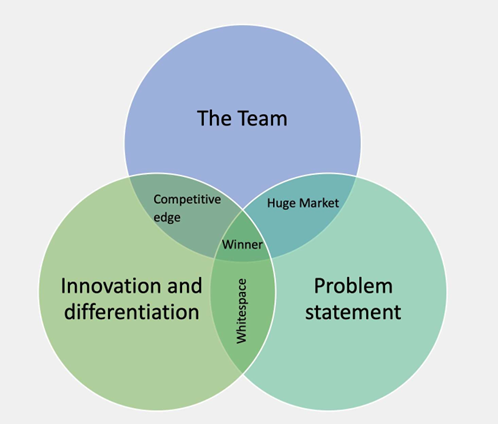

What Does Avinya Look for While Evaluating a Spacetech Deal?

- The Team: We back exceptional founders with deep industry expertise, a proven track record of execution, and a passion for tackling audacious problems.

- Problem & Solution: We invest in startups addressing significant pain points in the space industry or leveraging space-based solutions for challenges on Earth. The bigger the problem they solve, the more attractive the opportunity.

- Innovation & Differentiation: We seek disruptive approaches that stand out from the Our ideal startups demonstrate a clear technical advantage and a strong understanding of the regulatory landscape.

By focusing on these key areas, we aim to partner with visionary leaders who are shaping the future of spacetech and unlocking the immense potential of this industry.

From Our Angel Fund Portfolio: We are incredibly proud of our portfolio companies Pixxel and Piersight, two pioneering companies at the forefront of the Indian spacetech industry. Their dedication and innovation are truly inspiring.

PIXXEL: Pixxel is a spacetech company aiming to put a constellation of 30+ hyperspectral Earth observation microsatellites into a Sun-synchronous orbit with a mission to build a health monitor for the planet. This unique hyperspectral capability will unearth underlying, unseen problems that are invisible to current satellites. Google became WFC’s co-investor in Pixxel’s $36-million funding round in 2023. This was one of the first major foreign investments in India after the government introduced its privatization policy in spacetech.

PIERSIGHT: Founded in 2023 by former ISRO employee Gaurav Seth and former National Instruments official Vinit Bansal, Piersight is on a mission to transform the maritime industry through cutting-edge technology. With the critical need for persistent surveillance over the world’s oceans, Piersight has harnessed the power of Synthetic Aperture Radar (SAR) satellites to provide unparalleled coverage at a fraction of the current data costs.

Government Regulations and Support

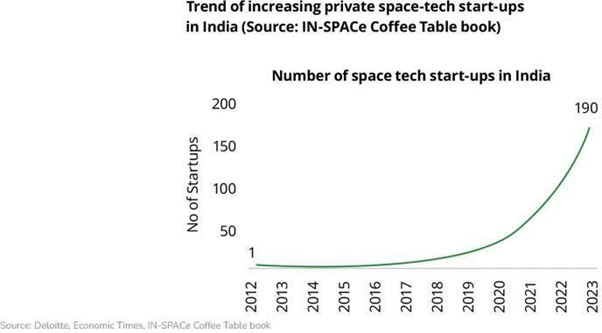

- The government is actively working to promote economic growth and fulfill societal demands through the spacetech industry, which has far- reaching effects.

- The private sector has been allowed to use ISRO facilities and other relevant assets to improve their capacities.

- IN-SPACe (Indian National Space Promotion & Authorization Centre) functions as an autonomous government organization mandated to promote, hand-hold, guide, and authorize space activities in the

- IN-SPACe has set a target to increase India’s share in the spacetech market from the current 2% to 8% by 2033 and 15% by 2047, the 100th year of The government believes that increased participation of the private sector, especially larger players, is key.

- Finance Minister Nirmala Sitharaman’s Interim Budget on February 1 allocated INR 7,313.73 crore for space research and spacetech.

- In the recent budget, Government of India has announced a dedicated 1000 cr VC fund to boost India’s space economy.

From the Managing Partner's desk

Gaurav VK Singhvi, Managing Partner, Avinya VC

The confluence of powerful macro trends, rapid technological advancements, and a growing awareness of the real-world applications of spacetech creates a truly unique investment opportunity. By backing visionary founders tackling critical challenges and pushing the boundaries of innovation, we’re not just investing in a burgeoning sector—we’re investing in a future where spacetech revolutionizes industries, improves life on Earth, and opens doors to possibilities once confined to science fiction.